The DAX benchmark suite has been expanded with new indices that cover composite size segments of the German equity market.

The DAX® All Cap, DAX® LargeMid Cap and DAX® MidSmall Cap offer investors one-stop exposure to combined large-, mid- and small-capitalization universes of stocks, adding to existing benchmarks such as DAX®, MDAX® and SDAX®.

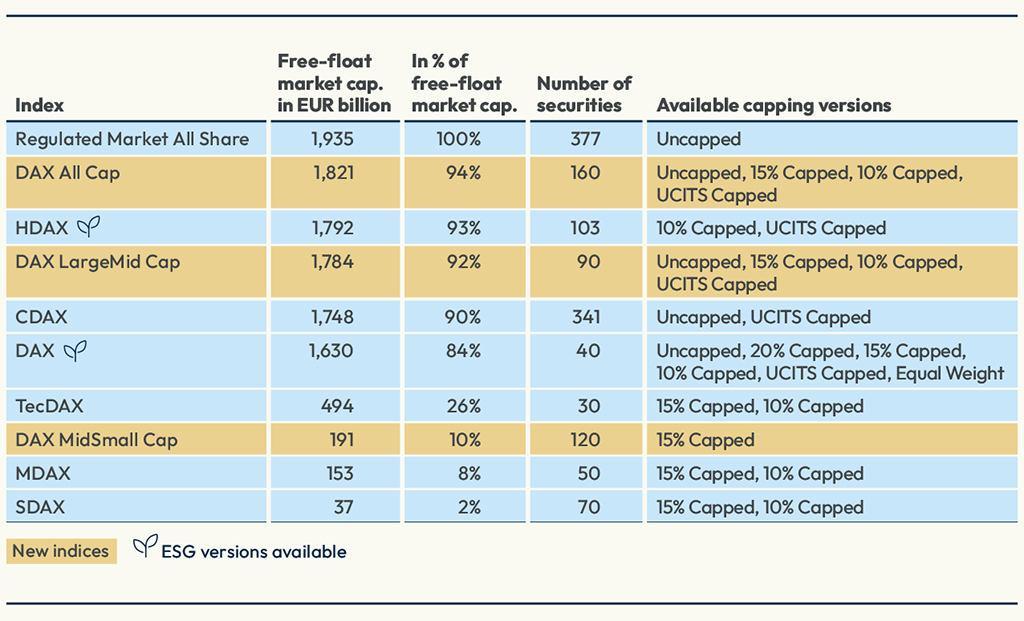

Figure 1: DAX benchmark universe

Figure 2 provides an analysis of the new indices’ composition. The DAX All Cap and DAX LargeMid Cap come with several capping alternatives.

Figure 2: Comparative profile of new DAX composite indices

“The new indices complete the DAX index landscape and expand the possibilities to construct portfolios and strategies in the German equity market, with the tested methodology and transparency that have made DAX the go-to market reference since 1988,” said Veronika Kylburg, Head of Global Benchmarks DAX, STOXX.

Performance

As can be expected, larger-capitalization stocks have a significantly bigger sway on performance. Figure 3 shows that the DAX LargeMid Cap follows the DAX closely, while it has diverged from the MDAX recently.

Figure 3: DAX LargeMid Cap vs. DAX and MDAX

Figure 4 shows a similar pattern, where the DAX MidSmall Cap mirrors the MDAX but has been less correlated with the SDAX. The DAX All Cap has a similar performance to the DAX LargeMid Cap.

Figure 4: DAX MidSmall Cap vs. MDAX and SDAX

Growing family

The DAX universe has seen extensive product and innovation activity in recent years. STOXX, which administers the DAX indices, in March 2024 introduced a family of ‘UCITS-capped’ DAX indices that comply with single-stock weight limits in the European Union directive, as well as DAX Selection Indices with a maximum component weight of 10%. In February this year, a DAX uncapped version and a DAX 20%-capped version were introduced. The flagship DAX in its most followed version has a single-stock cap of 15%.

Investors turn to German stocks

Interest in German stocks has climbed to a multi-year high this year, according to fund flows, on expectations that a new German federal government may spur economic growth.

Net purchases of German assets ETFs listed in EMEA[1] have climbed to EUR 3.1 billion this year,[2] the most for any similar period since data starts in 2015, according to ETFBook. Net flows into funds tracking a DAX family index[3] amounted to EUR 3 billion over the period, or 97% of the total. Of those, EUR 1.31 billion flowed into ETFs tracking the benchmark DAX, while a record EUR 1.37 billion was poured into MDAX benchmark funds.

[1] The analysis includes 70 funds with a German focus, covering equities and fixed income.

[2] Data through March 6, 2025.

[3] STOXX Ltd., part of the ISS STOXX group of companies, is the administrator of the STOXX and DAX indices under the European Benchmark Regulation.